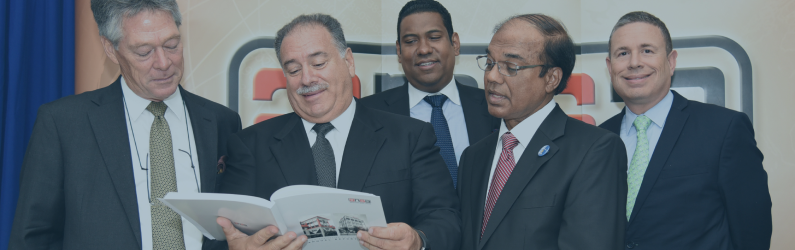

Anthony Sabga III (left) speaks with Andrew Sabga – Chief Executive Officer, A. Norman Sabga – Executive Chairman, David B. Sabga – Deputy Chairman and Adam Sabga – Construction Sector Head during the ANSA McAL Group of Companies’ Annual AGM on Thursday 24th May, 2018 at the Radisson Hotel in Port-of-Spain. PICTURE ANISTO ALVES

The ANSA McAL Group recorded a four per cent increase in revenue, up from from $6.001 billion in 2016 to $6.244 billion for the 2017 financial year. However, profit before tax was $986 million—less than the $1.107 billion achieved in 2016, while earnings per share (EPS) was $3.15 cents, down from $4.01 cents in 2016. A dividend of $1.50 was paid.

Group CEO Andrew Sabga announced these highlights of the comglomerate’s 2017 results at ANSA McAL’s 89th Annual General Meeting yesterday at the Radisson Hotel in Port-of-Spain.

“This is the fifth consecutive year of revenues exceeding $6 billion,” said Sabga, who described the 2017 figures as the “highest revenue in the history of the company.”

Noting that the strength of the Group is in its diversified portfolio, he told shareholders: “The beauty of a diversified portfolio is that when things are tough in one sector, there are always opportunities in other areas.

“We think that given our diversity, we are almost evenly spread. We are looking feverishly at how we can grow the areas that are not as large as the others to make sure that our diversity is such that it really does insulate us from any shocks in any one industry that may exist.”

The financial statements show that the Group produced strong operational results despite very challenging conditions in T&T and Barbados.

The report stated: “There was robust revenue growth across the region with Guyana exhibiting double digit growth at 11 per cent. Grenada and St Kitts grew revenue by nine per cent and seven per cent respectively. Revenues in the United States also increased significantly by 22 per cent.”

The 13 per cent decline in profit before tax was due mainly to slow spending by consumers in the automotive and media sectors, resulting in greater discounting to maintain market share.

According to the report, ANSA McAL’s strategy is to continue revenue growth while optimizing operating costs, thereby improving margins.

“The Group’s performance over the many years means expectations are rightly set at the highest level.

“The true test of a business, however, is its resilience through the economic troughs, to adopt to changes in the market and navigate bumps in the road, an ability the Group and its management team have demonstrated in spades for more than three decades,” the report stated.

Corporate Communications Department

ANSA McAL Group of Companies

Friday 25th May, 2018